Commercial Real Estate Loan How To Use Collateral And

A collateral loan is a secured loan that requires the borrower to provide an asset as security for repayment. With these loans, a lender can take possession of your property—the loan.

Understanding different types of real estate collateral

A collateral loan is a debt the borrower takes on by providing an asset to guarantee repayment. Also called a secured loan, a collateral loan requires the borrower to offer an asset to assure the lender of the borrower's intent to pay the loan in full. If the borrower fails to repay the loan, the lender has the right to take the asset as.

Lewis Real Estate Collateral The Goss Agency

Collateral allows secured personal loans to be offered to a wider range of consumers, including those who are considered higher risk. The reason is that the lender's risk is offset by the borrower's assets. Fixed Rate vs Variable Rate Loans There are other types of personal loans beyond secured versus unsecured.

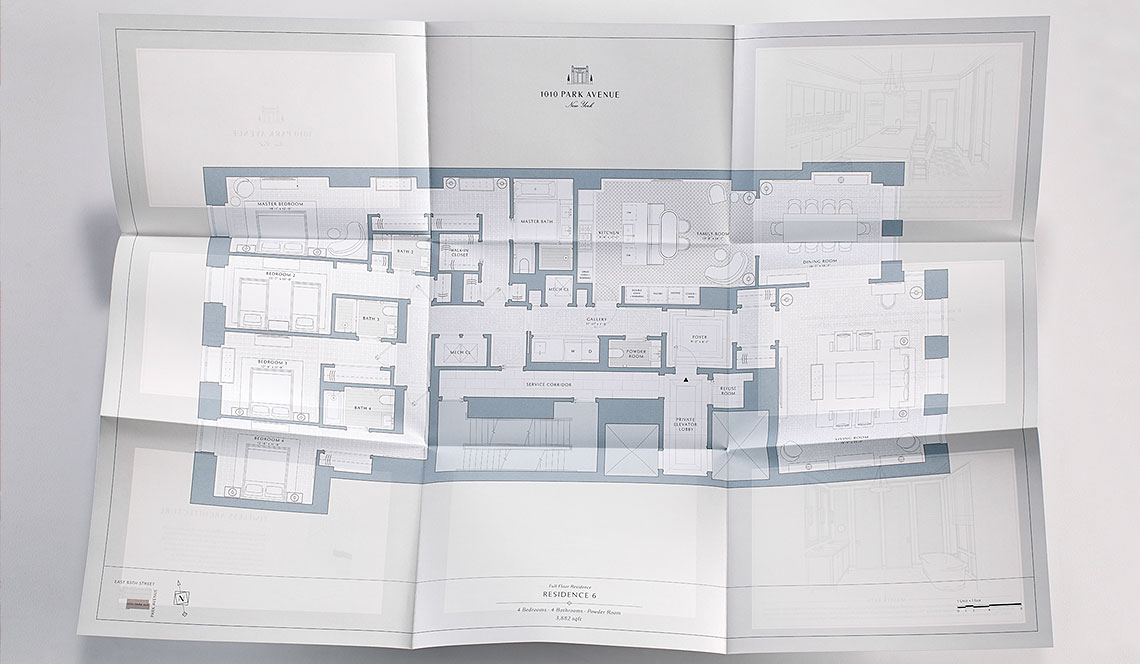

Real Estate Print Collateral Real Estate Branding Series RealestateMY

Real estate collateral is any personal property used to guarantee a mortgage loan. Typically a property used in real estate collateral loans could include buildings, factories, warehouses or even shopping malls - all of which are generally considered safer investments that have value and typically do not depreciate quickly.

CARSRealEstate_MarketingCollateralExamples NCEFT National Center for Equine Facilitated

Collateral is a thing of value that a borrower can pledge to a lender to get a loan or line of credit; common examples of collateral include real estate, vehicles, cash and investments.

Distinctive Real Estate Collateral for NoMad Residences Fine Commercial Printing, NYC, NJ, CT

] What Is A Real Estate Investor Line Of Credit? A real estate investor line of credit is a financing option that allows investors to tap into a property's equity, much like a business credit card. An investor line of credit is a relatively simple concept and provides investors with quick access to cash.

Using Real Estate as Collateral All City Bail Bonds

Real estate, including residential and commercial property, is frequently used as collateral for loans to protect lenders if a borrower defaults.Homeowners can benefit from real estate equity loans, businesses can expand their operations through real estate lending and rentals, and investors can earn up to 15% interest annually.

:max_bytes(150000):strip_icc()/collateral-9d1d0360292b4a06989957c5e3239fb5.jpg)

Collateral Definition and Examples

A Realtor.com coordinator will call you shortly What's next A coordinator will ask a few questions about your home buying or selling needs. You'll be introduced to an agent from our real.

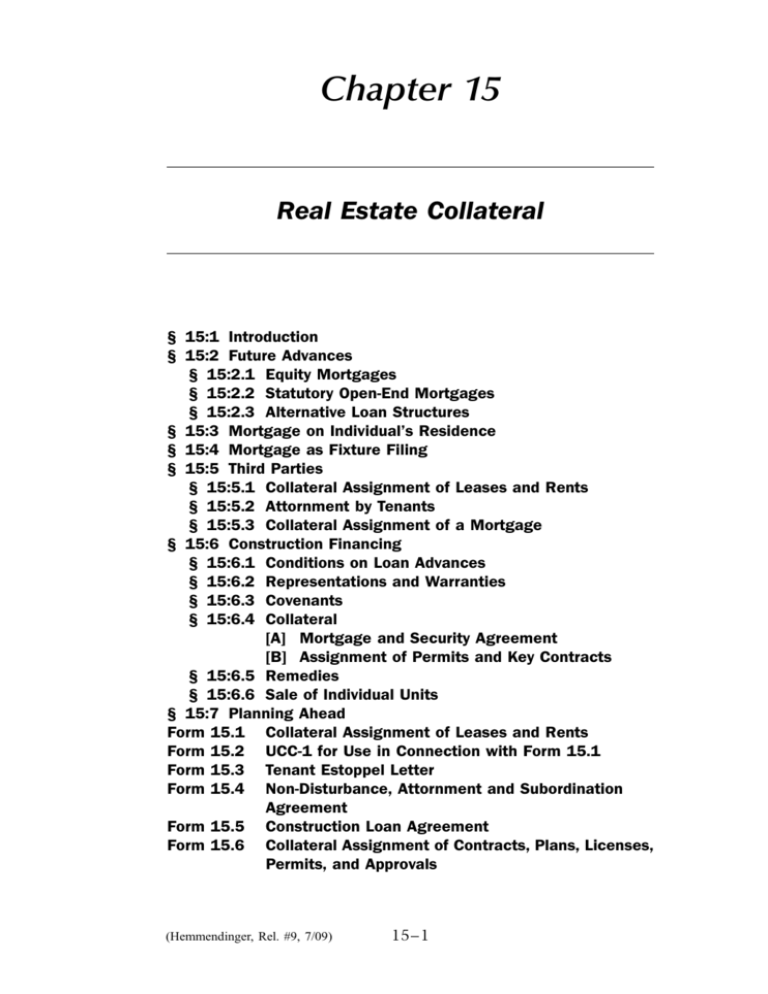

Real Estate Collateral

Asset based lending (ABL) is the practice providing a business financing based upon monetizing the company's balance sheet. If a company has assets such as accounts receivables, real estate, inventory, equipment and machinery, they can use them as collateral to obtain financing. The most common facility used for asset based financing is a.

Real estate marketing collateral designs by Isagodoy91 Fiverr

This type of collateral is a legal claim on all assets on the premises of the property (like construction equipment or fixtures) that can be repossessed should payments fall behind. First security interest allows the lender to sell any repossessed items as collateral to pay off the loan. Personal Guarantee

Real Estate Collateral Loans A Complete Guide for Borrowers Tasteful Space

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup.

Understanding different types of real estate collateral

Collateral is an asset that a borrower uses to secure a loan from a lender. When you take out a mortgage loan, your home is used as collateral. This means that if you default on your loan payments, the lender can take possession of your home through a legal process known as foreclosure.

Real Estate Collateral Mike Youtz, Design Professional

In real estate, collateral is a tool that diminishes one's risk in a transaction. It's about having something of value that belongs to the other party to "motivate" them to abide by the set rules. Let's discuss the real estate collateral definition a little further.

What is Collateral Substitution in Real Estate? YouTube

What is Real Estate Collateral? Usually, Real Estate is seen as the most prominent and commonly collateral while investing in the real estate market. Going a step further, property ownership can be one of the best Real Estate Collateral attached to your investments.

Real Estate Collateral Near You Printing in NYC, NJ, LI Fine Printing by Fine Commercial

Collaterals are some types of assets accepted by lenders and act as security for the borrowed amount. Some common types of assets include real estate, investments, gold, vehicles, and much more. These assets provide security to the lenders against potential defaults. If the borrower defaults on the repayment, the lender can repossess the.

Distinctive Real Estate Collateral for NoMad Residences Fine Commercial Printing, NYC, NJ, CT

Collateral refers to an asset that a borrower offers as a guarantee for a loan or debt. For a mortgage (or a deed of trust, exclusively used in some states), the collateral is almost always the.